Strategic Alliances

Partnering for Progress: The Importance of Smart Strategic Alliances

MIG is always on the lookout for opportunities to create strategic alliances that benefit our portfolio companies and align with our strategic interests.

These alliances can take many forms, including Joint Ventures, Mergers and Acquisitions, and Equity-direct Investments.

Renewable Energy

We are particularly interested in forming alliances in the energy space. With the world's growing energy needs and the increasing demand for renewable energy sources, we are keen to partner with companies that are at the forefront of innovation in this sector. By scaling the operations and bringing their products and services to new markets.

Food Processing and Agriculture

With the global population projected to reach 9 billion by 2050, there is a growing need for sustainable food production and distribution systems. We are looking to partner with companies that are developing innovative solutions in this area, such as precision agriculture, plant-based proteins, and vertical farming.

Health Care

In the healthcare sector, we seek strategic alliances with companies that are developing innovative solutions to address the world's most pressing healthcare challenges, such as; aging populations, rising healthcare costs, and the need for personalized medicine.

Fintech

Technology and in particular the Fintech sector is our core; with the rise of digital payments, blockchain technology, and artificial intelligence, there is a growing need for innovative financial services solutions. We are looking to partner with companies that are developing new payment systems, lending platforms, and investment tools that can disrupt traditional financial services models.

Real Estate

Luxury Real Estate opportunities and Near-Shoring for manufacturing and logistics companies are our primary focus in the real estate sector. We understand the importance of proximity to manufacturing and logistics companies, and we are committed to identifying prime locations for luxury real estate developments across high-end emerging destinations.

2005

Launching Year

450+

Number of Employees including portfolio companies

5.50M B USD +

Advised & Portfolio investment

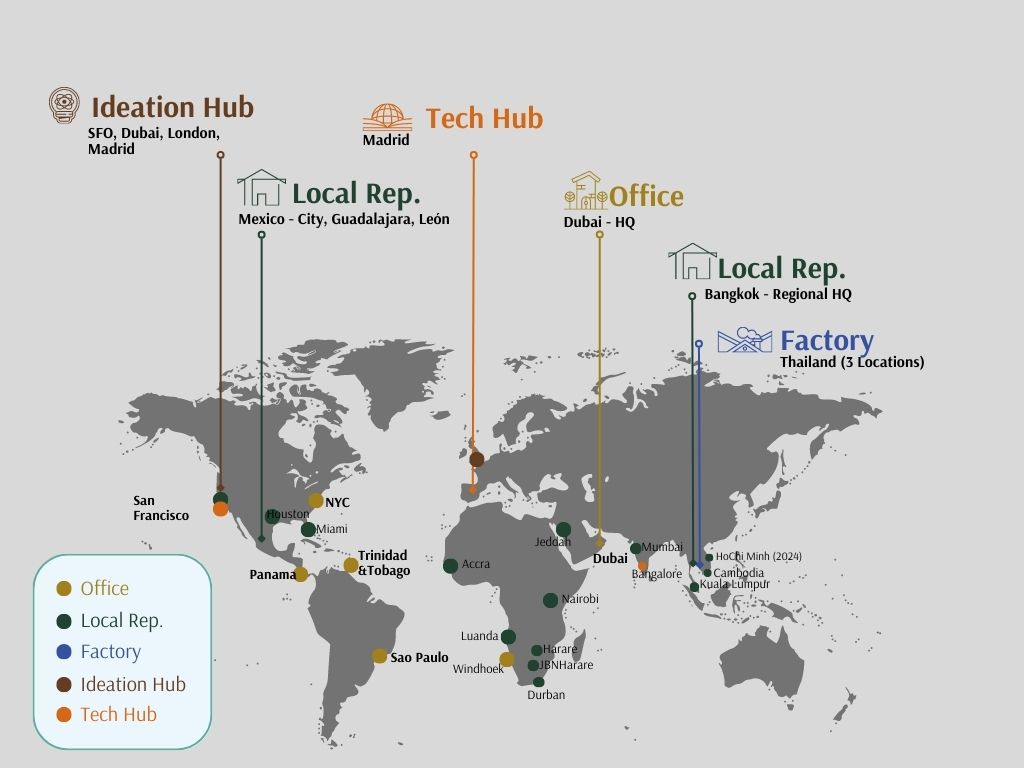

Locations

- Europe

- Africa

- Latam

- Middle East

- Asia

Key Markets

- Structured Corporate Finance

- Smart Infrastructures & Services

- Public Private Partnerships

- Commodity Trade Finance