Commodities

Supporting the Full Agriculture Lifecycle, for Healthier Communities

MIG specializes in the trade and financing of agricultural products such as sugar, soybean, corn, coffee, and rice. We provide capital and financing, risk management, market access, and physical execution and logistics services globally.

MIG Trade Finance Infrastructure is a leading specialist in Commodity Trade Finance, emphasizing the Food, Oil & Gas, and Mineral sectors, including essential commodities such as Iron ore, Manganese, and other resources. Our state-of-the-art Trading Hub offers comprehensive support to commodity trading companies, enabling them to thrive in the ever-changing landscape of these industries. We achieve this by providing adaptable cost structures, well-defined entry and exit strategies, and seamless IT platform integration to ensure smooth operations.

Oil & Gas

Our proficiency in the Oil and Gas sector is demonstrated through our vast knowledge and experience in supplying top-quality products to a diverse range of clients, including End Users, Major Corporations, and Government Agencies across Africa, Asia, the Middle East, and the Caribbean. By partnering with like-minded organizations that share our commitment to maintaining high international operational standards in the fuel industry, we ensure that our clients receive the best possible service and support.

The MIG Commodity team boasts a proven track record of successfully delivering a wide range of Products. This accomplishment has enabled us to expand our product and service offerings while solidifying MIG's presence in the fuel industry. Our expertise and experience equip us with the necessary tools to help companies successfully navigate the intricacies of commodity trading within these specialized industries.

At MIG Trade Finance Infrastructure, we understand the challenges and opportunities that come with trading in the Food, Oil & Gas, and Mineral sectors. Our dedicated team of professionals is committed to providing unparalleled support and guidance to our clients, ensuring they can adapt to unforeseen changes in trade flows, currency fluctuations, and commodity prices. By offering tailored solutions and leveraging our extensive industry knowledge, we empower our clients to excel in their respective markets.

2005

Launching Year

450+

Number of Employees including portfolio companies

5.50M B USD +

Advised & Portfolio investment

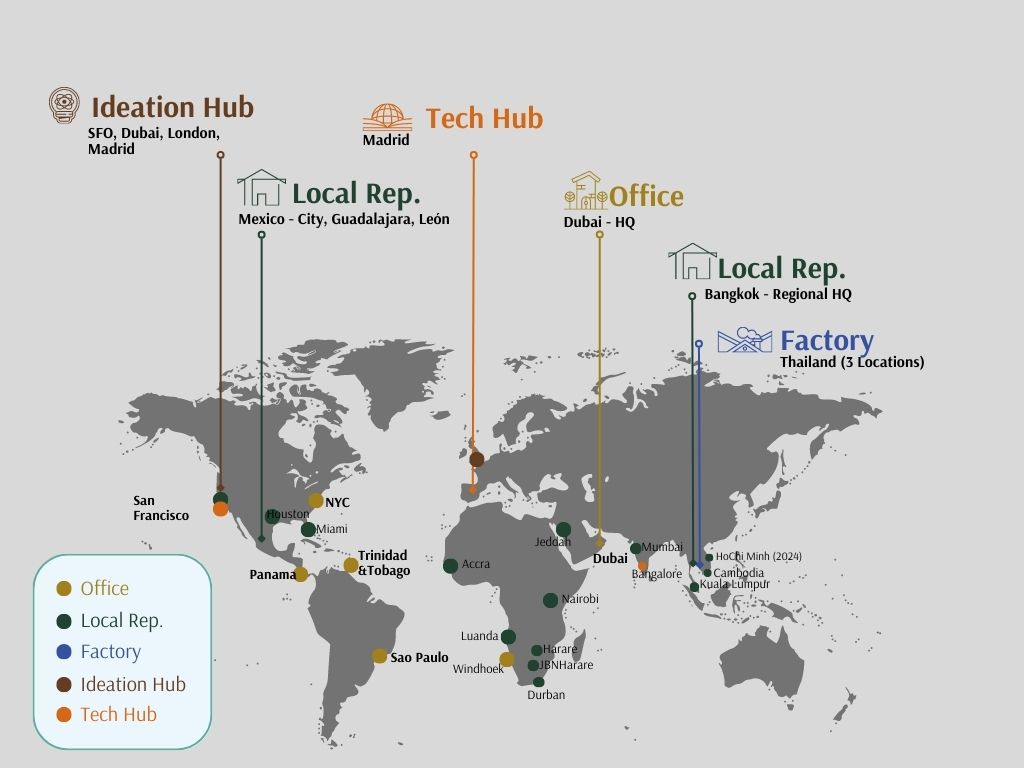

Locations

- Europe

- Africa

- Latam

- Middle East

- Asia

Key Markets

- Structured Corporate Finance

- Smart Infrastructures & Services

- Public Private Partnerships

- Commodity Trade Finance