Real Estate

Investing in Real Estate, Building Sustainable Futures

Property investment solutions through segregated and pooled structures, seeking to maximize risk-adjusted returns.

We seek to utilize our global presence and expertise to generate attractive returns for our investors in any environment and to make a positive impact on the communities in which we invest.

Distress Opportunistic Portfolios

- Our opportunistic business seeks the acquisition and management of Real Estate and collateralized distressed debt portfolios at a significant discount. The business rationale consists of acquiring discounted undermanaged assets and, the execution of follow-on turnaround strategies for quick commercialization. Post-acquisition, we also invest in the properties to improve them before selling the assets and returning capital to our limited partners.

- Our real estate and investment professionals have created structures that offer downside protection, mitigate risk and align the interests of participating parties. Each opportunity is evaluated based on the underlying value of the asset and the risks associated with correcting the situation to unlock value.

Direct Investments

- Real Estate investments with a long investment horizon. Primarily in real estate investment trusts of various types, including; multifamily, Industrial warehousing, health care, and luxury development in selected areas.

Debt

- We offer different financing solutions for selected projects. We originate loans for high-end luxury real estate and logistic parks.

2005

Launching Year

450+

Number of Employees including portfolio companies

5.50M B USD +

Advised & Portfolio investment

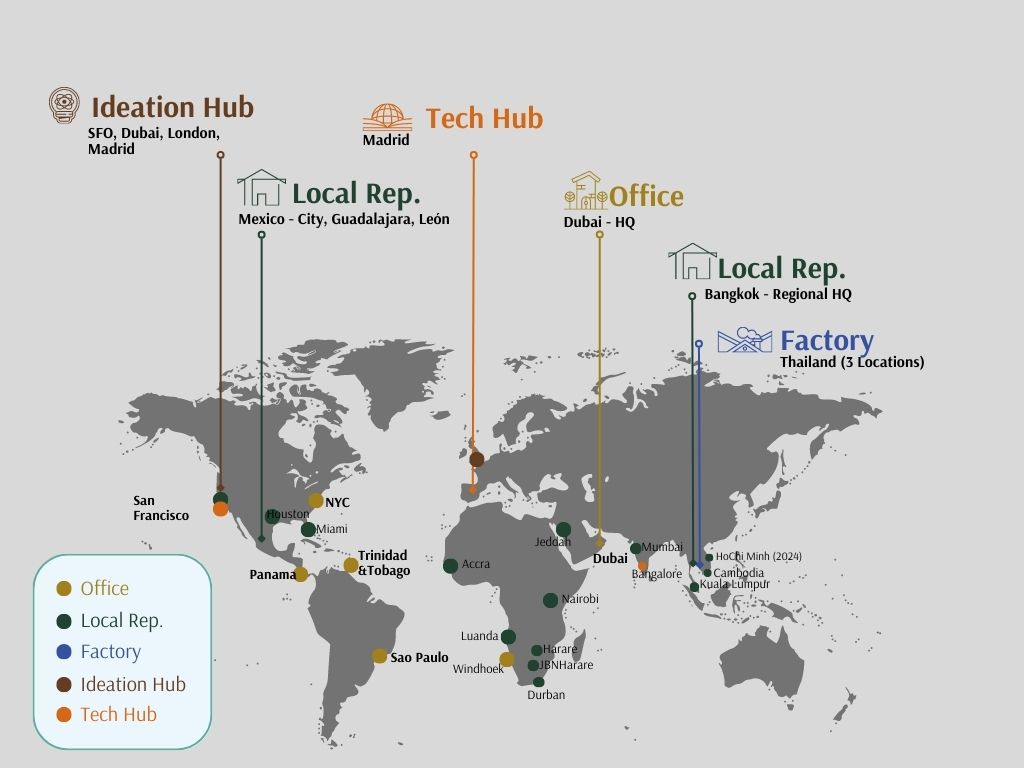

Locations

- Europe

- Africa

- Latam

- Middle East

- Asia

Key Markets

- Structured Corporate Finance

- Smart Infrastructures & Services

- Public Private Partnerships

- Commodity Trade Finance