Private Equity

Investing in the businesses that shape the economy of the future

Our Private Equity Division invests in opportunistic growth-oriented firms to accelerate their high-performance growth and expansion.

We specialize in lifecycle investment management of strategic growth and lucrative exit initiatives, offering funding and services for mergers and acquisitions, market expansion, joint ventures/strategic alliances, restructuring, turnarounds, and sales.

Our approach is based on aligning MIG’s interests with our client's interests to achieve true value and tailoring the engagements towards extended reach and opportunity.

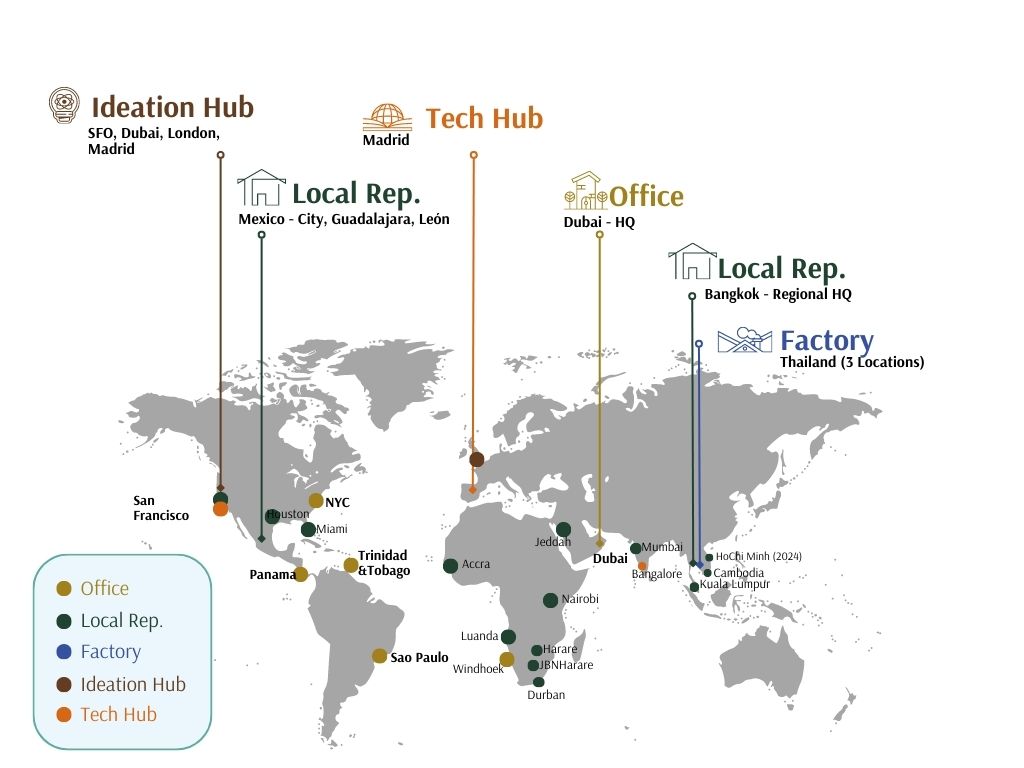

MIG has a globally integrated team of industry experts with deep vertical expertise and extensive networks and core relationships in all the world's regions to unlock regional and global growth opportunities for their clients.

MIG engages only in friendly transactions and works with talented management teams to achieve positive results.

We strive to create value by investing in great businesses where their capital, strategic insight, global relationships, and operational support can drive transformation.

We focus on

Robust & Detailed Due Diligence process that measures risk while identifying catalysts for increased value.

Re-Positioning

Focused on capital injection, strategic insight, global relationships, and operational support to drive transformation.

Consolidation Phase

Company consolidation with a long-term investment approach.

2005

Launching Year

450+

Number of Employees including portfolio companies

5.50M B USD +

Advised & Portfolio investment

Locations

- Europe

- Africa

- Latam

- Middle East

- Asia

Key Markets

- Structured Corporate Finance

- Smart Infrastructures & Services

- Public Private Partnerships

- Commodity Trade Finance